Being able to find the accurate market value of an investment is an incredibly important skill to develop.

Also known as its ‘intrinsic value’, it’s vital to know, principally so that you know whether you’re getting a good deal or not.

Ideally you want to be purchasing below the market value…and avoiding paying over.

So, how do you go about it?

The Market Value Gold Standard

There is a benchmark in the industry which is the Registered Institute of Chartered Surveyors (RICS).

These are independent professionals who find the market value of properties on a daily basis, so who better to value your potential investment?

This is exactly why mortgage lenders will always require a RICS valuation before proceeding…as will most other commercial lenders.

Of course, they require payment for providing this service however depending on the situation it could well be beneficial (or required) to acquire one.

But even with a RICS valuation the estimation can vary between individual surveyors.

It’s never going to be 100% accurate because how can it?

You may have heard me say this before:

The value of anything comes down to supply and demand.

If lots of people are looking to buy and there is limited stock of property, the value you can achieve will likely increase…and vice versa.

The value is ultimately decided by the seeing what the most that you can get for it is…i.e. by finding out whatever somebody is willing to pay for it…

Which is a comment that segues nicely into my next point…

Sold Comparables

RICS valuers will look at an array of factors when deciding upon their valuation…the most significant of which is likely this section’s namesake: sold comparables.

This is something that you can, and absolutely should, be doing as part of your own due diligence. It will get you pretty close to the market value if you do it well.

I want to highlight the word “sold” here.

It’s not a lot of use comparing your potential property to other properties that are just sitting on the market purely because their value hasn’t been decided yet. Nobody has purchased it. Nobody has attributed a value to it.

Moreover, it’s not uncommon for estate agents to promise that they can achieve a massively inflated price simply to win the business. They’ll promise you the world…which is precisely why you should be following the information in this article, even if selling.

So, let’s be clear…you want to find sold comparable properties…

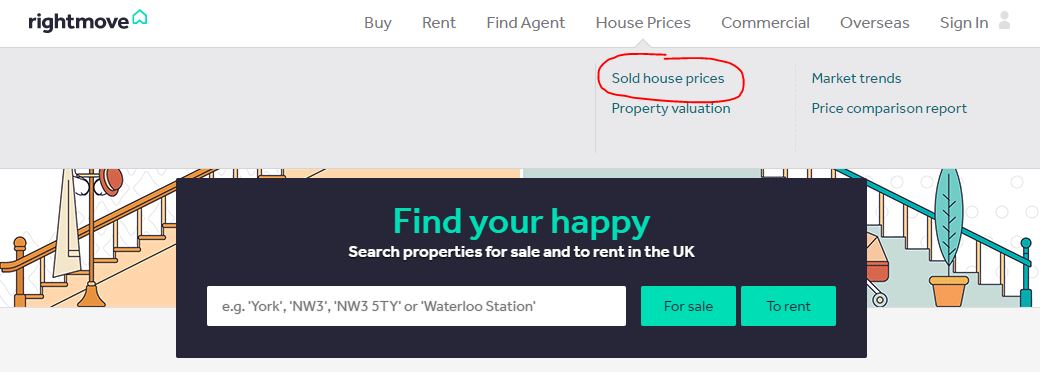

Rightmove has a handy section that will help you with this.

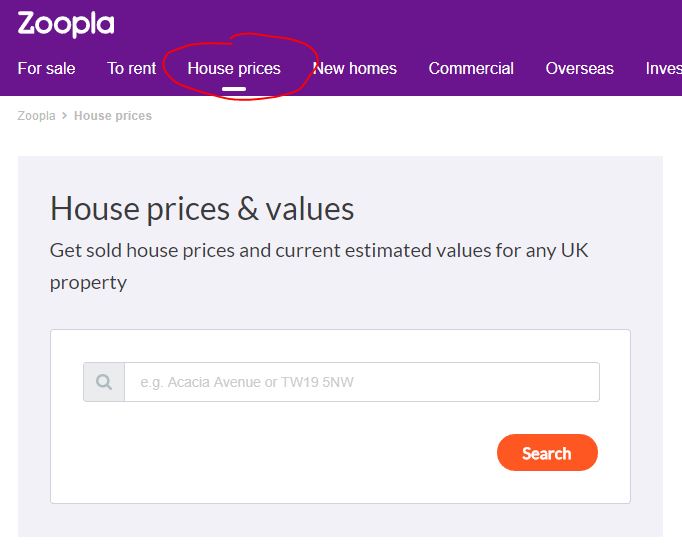

As does Zoopla…

Both good places to start to find average sold prices, which can tell you a lot…but it’s also lacking.

While average is…ok….ideally you want to get as accurate to your specific property as possible.

Averages won’t tell you much about condition. In fact, they’ll result in giving you the market value for an ‘average’ property in any given area.

It takes a bit of time but go through all of the sold properties that are as close to your potential investment as possible, also trying to match the property type and condition…as well as aiming to compare the most recent sales.

Depending on the area, this can vary hugely in difficulty.

You could have a row of identical, terraced houses or you could have a unique, detached property in the middle of nowhere.

Clearly the former of these situations is going to be a lot simpler. Finding the market value of something with no comparables is ridiculously hard…although unique properties do tend to be more valuable for this very reason.

See where yours fits in, use this data to benchmark your property against and you should start to build a relatively good picture of the market value of the property in question.

Is it similar in condition but a bit bigger? Factor that into the value.

Is it a bit smaller but nicer in condition? Factor tha-…I think you get it.

Automated Valuation Models (AVMs)

If you’ve played around on Zoopla, you will have noticed that it gives you an estimated market value. This is an AVM.

Wikipedia’s definition of AVMs:

Automated valuation model (AVM) is the name given to a service that can provide real estate property valuations using mathematical modelling combined with a database. Most AVMs calculate a property’s value at a specific point in time by analyzing values of comparable properties. Some also take into account previous surveyor valuations, historical house price movements and user inputs (e.g. number of bedrooms, property improvements, etc.).

Some of these are better than others.

For instance, in my experience…I’ve never found Zoopla to be particularly accurate.

However, this may change in future as they’ve recently acquired ‘Hometrack’…which is a website that offers another AVM.

I’ve used Hometrack many times and, most of the time, it’s been in a good ball-park. It is one of the Wiki-aforementioned services that takes into account previous and nearby surveyor valuations.

The problem with Hometrack is that it’s not a free service, they charge £20 per report which obviously isn’t ideal if you’re actively weighing up lots of potential properties.

Regardless, they still suffer the same issue of not being able to assess the condition of the property as well as various other variables that require a human eye so they can’t be taken as gospel but can certainly steer you roughly into the right direction.

Price Per ‘X’

It can be handy to work out the price per square meter or price per square foot…particularly if you focus on a particular area regularly.

You could build up tables in different postcodes for varying condition levels, depending on how keen you are. This would need to be updated fairly regularly though.

Most property listings have floorplans nowadays that give you the floor area so you can easily work this out.

Alternatively, you should be able to find the floor area on the EPC for the property if you can get your hands on it.

Mix & Blend

As you can see, it’s hardly an exact science…and it never will be.

The market is constantly changing based on a huge amount of reasons that affect supply and demand on both a macro and minor scale.

Not only that, it requires a human touch to make a judgement call.

It’s a case of using a variety of the methods explained above and arriving at your best guess. With any luck you shouldn’t be too far wrong…and that should be enough to decide whether you need to be spending more time looking into the project or not.

If in doubt, get a RICS valuer in.